In recent years, nations around the globe have turned their attention to buildings – which, including their construction and operation, are responsible for almost 40% of global annual greenhouse gas emissions (GHGs). Cities and countries are trying to reduce their carbon footprints by imposing stricter emissions regulations on commercial properties. Here are some of the regulations, tax abatements, penalties, tax credits and benefits related to carbon emissions, carbon dioxide removal and climate change mitigation plans:

LL97 or Local Law 97

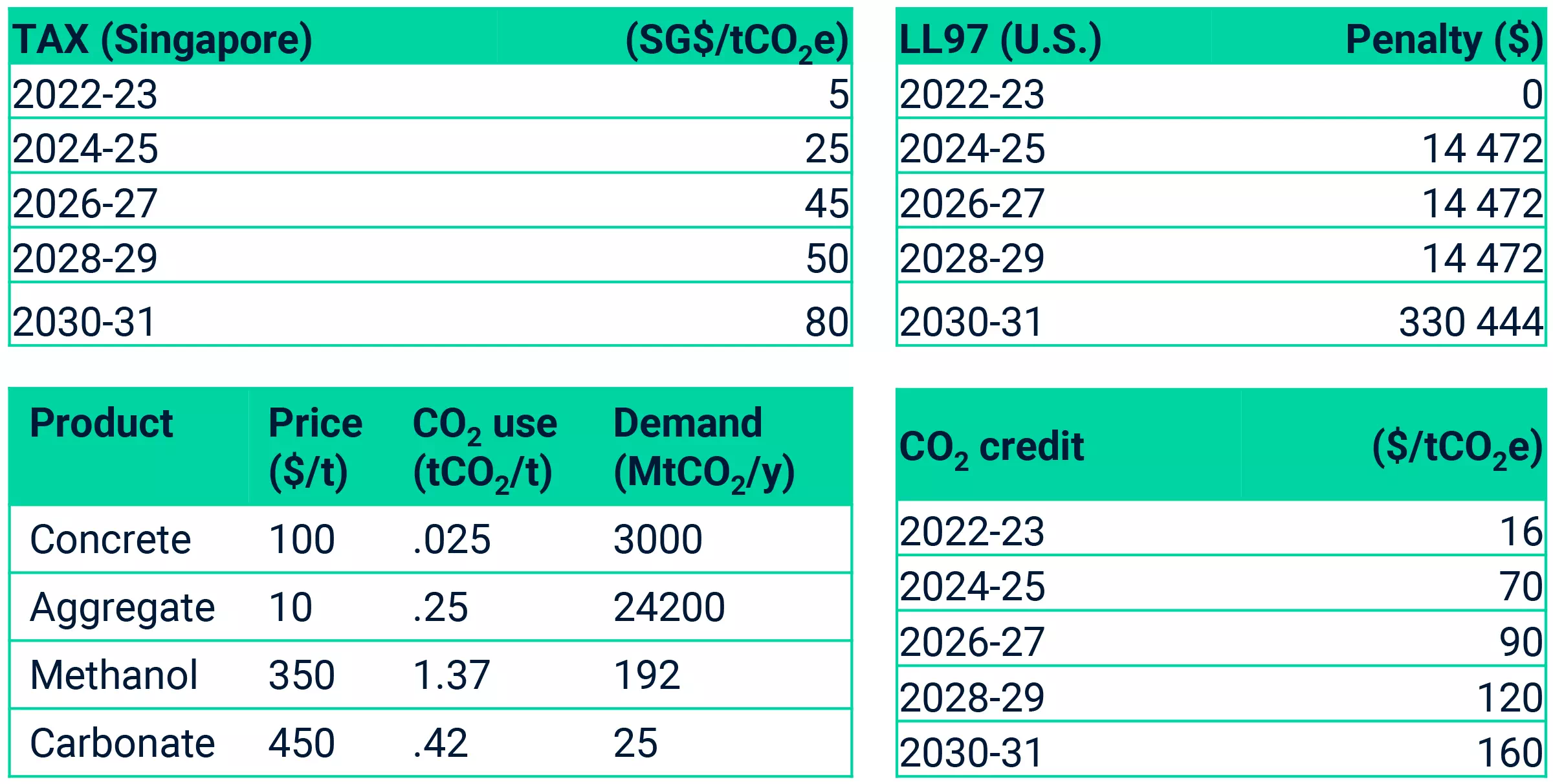

Local Law 97 penalties (2024, NY, United States) — LL97 places carbon caps on buildings that exceed 25,000 sq ft. It also affects two or more buildings on the same tax lot that together exceed 50,000 sq ft. Landlords who do not comply are subject to fines beginning in 2024 and will face even harsher penalties by 2030. By May 2025, any building that is impacted by Local Law 97 will have to file an annual Greenhouse Gas Emission report stating whether the building either complies with regulations or how much it exceeds the specified limits. LL97 penalties depend on the type of building and its current emissions. To avoid these penalties, the building owner must reduce emissions below 2538 tCO2e/year by 2024, and below 1,359 tCO2e/year by 2030. A penalty of $268 is charged for every metric ton of CO2 equivalent above the limit.

At the bottom of this article, we have shared a calculation of how much fine you will have to pay for emitting from your building.

To determine compliance, visit the LL97 Getting Started guide at their official website. Benchmarking, Reporting, Adjustments, Deductions, and Timelines and Key Dates will be key to compliance under Local Law 97.

NY Carbon City Property Tax Abatement Act

The New York Carbon City Property Tax Abatement Act (2022, New York) aims to accelerate carbon tech growth in NYC by creating an incentive for building owners to adopt a range of qualified technologies. The proposal is modeled after similar successful PTA programs already in place for solar, battery storage and green roofs.

Section 45Q

Tax Credit for Carbon Sequestration (United States) — 45Q is the tax credit that’s luring US companies to capture CO2. 45Q creates a tax credit for the sequestration of carbon dioxide captured from an industrial source. To qualify for this tax credit, construction has to begin before 2024, and DAC has to capture at least 100,000 metric tons. $20/t for permanent CO2 storage and $10/t for utilizing CO2 as a tertiary injectant

LNET

Luxembourg Negative Emissions Tariff (2022, Luxembourg) — Government grants premium/ton CO2 removed through five-year contracts. L-NET is designed to trigger local and global investment in carbon dioxide removal projects, with the aim of accelerating scale-up and cost reduction for promising durable and verifiable CDR solutions.

CDRLA

Carbon Dioxide Removal Leadership Act / CDRLA (A8597/S8171) (January 2022, United States) is a multi-state legislative mission to create Carbon Dioxide Removal (CDR) procurement programs across North America and the world. The CDRLA creates a state-run procurement program, starting in 2025, to scale carbon removal from zero to a level sufficient to balance the state’s residual “hard-to-abate” emissions (15%) and allow New York to achieve a true net zero by 2050. Under this law, the state will use reverse auctions to purchase measurable and verifiable removals.

LECCLA

Low Embodied Carbon Concrete Leadership Act (2019, NY) is a tax credit specifically for concrete manufacturers. LECCLA proposes that Concrete producers bidding on public projects in New York will be ranked based on the global warming potential (GWP) value of their concrete, in addition to the cost. For producers with the lowest GWP score, a 5% price discount is applied to their bid price, making it more competitive. For concrete producers that use any carbon capture, utilization, or storage technology, an additional 3% discount will be applied. The full text of the proposed LECCLA legislation is available at the New York Assembly.

CAIP

Climate Action Incentive Payment (2022, Canada) — As part of the Government of Canada’s climate change plan, eligible residents of Alberta, Ontario, Manitoba and Saskatchewan can receive the Climate Action Incentive Payment (CAIP) to decrease energy usage, save money, and reduce carbon pollution.

Carbon Tax

In 1990, Finland was the world’s first country to introduce a carbon tax. Sweden has the highest carbon tax rate worldwide followed by Switzerland and Liechtenstein. There are 64 carbon pricing initiatives currently in force across the globe on various regional, national, and sub-national levels, with three more scheduled for implementation, according to The World Bank. Singapore is the first country in Southeast Asia to implement a carbon tax in 2019. The carbon tax, at S$5 per tonne of greenhouse gas emissions (tCO2e). From 2024, large emitters in Singapore will have to pay S$25 (~US$18) for each tonne of carbon dioxide equivalent (tCO2e) they emit, increasing to S$45 in 2026 and 2027 (~US$33), and eventually to between S$50 and S$80 by 2030 (~US$36 to US$68).

MEES

Minimum Energy Efficiency Standards (2023, England and Wales) — From April 2023, landlords will need to meet the rating of E and above in order to continue renewing and granting their leases. From April 2030, all commercial buildings must be made efficient enough to meet or exceed a B rating. Otherwise, 2 out of 3 of London’s commercial properties might become valueless.

GEG

Buildings Energy Act (2020, Germany) — Combines numerous building efficiency regulations and implements the European requirements for the energy performance of buildings.

Bylaw

Montreal’s Building Emissions Bylaw (2022, Canada) — The bylaw will require owners to disclose the forms and quantities of energy their buildings consume each year, necessitating careful cataloging of energy expenditure. In 2022, buildings over 160,000 sq ft will be assessed, in 2023 over 50,000 sq ft, and in 2024 over 20,000 sq ft will be included.

Dubai’s Green Building Regulations & Specifications (UAE)

Launched in 2011 the Dubai Green Building Regulations and Specifications initially targeted government-owned buildings. In 2014 they extended to all new commercial, public, and industrial buildings as well as many existing buildings. By 2030, the regulations aim to have all new buildings operating at net zero carbon and, by 2050, all buildings – new and existing – should be operating at net zero.

Inflation Reduction Act of 2022 (US)

The Inflation Reduction Act of 2022 provides billions of dollars of incentives to companies that perform carbon capture. Specifically, the federal government will pay them $180 a ton to capture carbon from the air using DAC approaches. If power plant operators can install DAC systems that cost less than $180 a ton to operate, they can turn a profit while helping the U.S. meet its emissions goals.

Energy Performance of Buildings Directive – EPBD (EU)

The Energy Performance of Buildings Directive (EPBD) aims to transform Europe’s buildings into a highly energy-efficient stock by 2050. Residential buildings would need to achieve at least energy performance class E (on a scale going from A to G) by 2030, and D by 2033 (as opposed to F and E under the Commission’s proposal). Non-residential and public buildings would have to achieve the same classes by 2027 and 2030 respectively. A limited set of exemptions would apply for monuments or buildings of special architectural or historical merit, technical buildings, temporary use of buildings or churches and places of worship, and public social housing where renovations would lead to rent increases that cannot be compensated by saving on energy bills. Member states would need to put in place free-of-charge information points and cost-neutral renovation schemes. Financial measures should prioritize deep renovations, especially of the worst-performing buildings, and targeted grants and subsidies made available to vulnerable households. Member States should ensure that the use of fossil fuels in heating systems for new buildings or those undergoing major renovations to the building or the heating system are not authorized from the date of transposition of this Directive. They should be totally phased out by 2035 unless the European Commission allows their use until 2040.

75% of existing buildings are inefficient in terms of energy and will require energy renovation on a large scale.

Solar energy installations must be installed on:

as of 2027: all new public and non-residential buildings (useful floor area over 250m2)

as of 2028: all existing public and non-residential buildings undergoing thorough renovation (useful floor area over 400m2)

as of 2030: all new residential buildings

Existing buildings:

Non-residential buildings:

Member states to set up minimum energy performance standards = maximum amount of energy that buildings could use per m2 annually (based on total building stock in January 2020). There will be two thresholds, one of “15%” and one of “25%” representing the national building stock above these thresholds.

by 2030 all non-residential buildings will need to be below the established 15% threshold.

by 2034 all non-residential buildings will need to be below the established 25% threshold.

Residential buildings:

The average primary energy use of all residential buildings is at least at:

by 2033: D energy performance class level

by 2040: at the level set by each country that ensures reaching zero-emission building stock in 2050

As of 2050, all existing buildings should be transformed into zero-emission buildings

Turning Buildings into Carbon Sinks

With Soletair Power’s ‘plug-and-play’ building-integrated carbon capture technologies, CO2 can be captured from the air, emissions can be offset and emission data can be monitored and collected easily right from the building. Captured CO2 can be utilized in a number of ways. This also ensures CO2-lean air benefits for the building residents.

FAQ

How Much Will My Building Be Charged for Emissions Under LL97 or Local Law 97?

LL97 applies a penalty of $268 for every tCO2e above the limit (2538 tCO2e from 2024 and 1359 tCO2e from 2030). Suppose, our example building has an annual emission of 2592 tCO2e. The building would be subject to the following penalties unless its emissions are reduced before each respective period:

2024-2029 penalty = 54 tCO2e x $268/t = $14,472 / year

2030-2034 penalty = 1,233 tCO2e x $268/t = $330,444 / year

The penalty for the second period (2030-2034) is around 22 times higher than the penalty for the first period (2024-2029), and this is due to the lower emissions limit. To avoid these penalties, the building owner must reduce emissions below 2538 tCO2e/year by 2024, and below 1,359 tons CO2e/year by 2030.

Learn more about our

carbon capture technology

You may feel that having a proper DAC-integrated ventilation system for your office building is unnecessary due to the cost of purchasing, installation, and maintenance. But is that true? On the page below, you shall learn more about the technology and its immense benefits.